During the early 1980s, he’d made hundreds of millions of dollars trading stocks, doing real estate deals and masterminding leverage buyouts of distressed businesses.

He was lauded as a financial genius in many magazine and newspaper articles and often invited to speak at business seminars, colleges and universities.

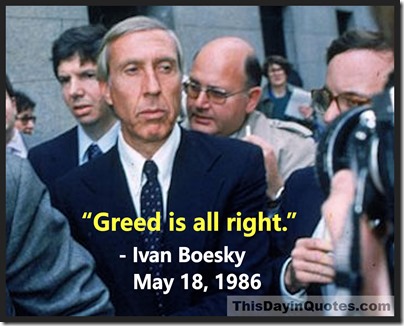

On May 18, 1986, Boesky gave the commencement address at the UC Berkeley’s School of Business Administration.

One of the things he told the students in that speech became a famous (and infamous) quotation that led to an even more famous movie quote.

“Greed is all right, by the way,” he said blithely. “I want you to know that. I think greed is healthy. You can be greedy and still feel good about yourself.”

Boesky was feeling less good the following year.

Federal SEC investigators had discovered that many of Boesky’s huge stock profit windfalls were based on illegal insider information.

In November 1986, he was arrested and eventually convicted, after providing evidence that led to the downfall of some of his other ethically-challenged Wall Street friends, including financier Michael Milken.

Based on a plea deal, Boesky was sentenced to 3 1/2 years in prison and required to pay a record-breaking fine of $100 million.

Boesky’s rise and fall and his “Greed is all right” speech were part of filmmaker Oliver Stone’s inspiration for the movie Wall Street.

Stone co-wrote the script and directed the film, which was released on December 11, 1987 in U.S. theaters.

The movie stars Michael Douglas as Gordon Gekko, a ruthless Wall Street investor who specializes in hostile takeovers, leveraged buyouts, and junk bond financing.

In fact, he’s proud of his takeover record, as he explains in the memorable speech he gives that includes the line usually misquoted as “Greed is good.” It’s a pithier, shortened version of what Douglas actually says.

In that scene, he’s speaking to a meeting of shareholders of the company Teldar Paper, which he wants to take over.

To encourage them to approve his takeover bid, he tells them he has studied the company and found that the current management is wasting money and shortchanging shareholders.

Then he says:

“I am not a destroyer of companies. I am a liberator of them. The point is, ladies and gentlemen, that greed, for lack of a better word, is good. Greed is right. Greed works. Greed clarifies, cuts through and captures the essence of the evolutionary spirit. Greed, in all of its forms – greed for life, for money, for love, knowledge – has marked the upward surge of mankind and greed, you mark my words, will not only save Teldar Paper but that other malfunctioning corporation called the USA. Thank you.”

The Teldar shareholders like what Gekko says and give him a standing ovation.

Despite the fact that Gekko is a slimy character who, like Boesky, ultimately goes to prison for insider trading — and despite the financial scandals and meltdowns that happened before and after Wall Street was released — there are still those who essentially agree with what he and Boesky said about greed.

It’s fits the Ayn Randian “enlightened self-interest” creed of the wealthy 1%ers and others who support the ideal of unfettered capitalism and oppose “over-regulation” of businesses — a subset of people who have increasingly dominated American politics.

It’s fits the Ayn Randian “enlightened self-interest” creed of the wealthy 1%ers and others who support the ideal of unfettered capitalism and oppose “over-regulation” of businesses — a subset of people who have increasingly dominated American politics.

Indeed, the economic and political trends of the past few decades could be summed up by something else Gordon Gekko says in Wall Street.

He explains to his protégé in the film, played by Charlie Sheen:

“The richest one percent of this country owns half our country’s wealth, five trillion dollars...We make the rules, pal. The news, war, peace, famine, upheaval, the price per paper clip. We pick that rabbit out of the hat while everybody sits out there wondering how the hell we did it. Now you’re not naïve enough to think we’re living in a democracy, are you buddy?”

Flash forward to Ivan Boesky three decades later.

After being busted in 1987, he spent a mere two years in the Lompoc Federal Prison Camp in California.

And, although he was permanently prohibited from involvement in the realm of stocks and finance and was required to pay out much of his past fortune in fines, he’s still better off than most of us.

In 1991, he divorced his wife Seema, who came from a wealthy family and had her own fortune.

She agreed to pay him $23 million and $180,000 a year for life. She also gave him one of their mansions, in La Jolla, California.

As of 2019, at age 82, Boesky still lives there. According one recent article, he is now “a wild-haired Rasputin-like recluse.”

I imagine him looking at the continuing wealth gap in America and who's in the White House and thinking, with some chagrin, that our country is clearly still run by people who believe in the greed principle he espoused. People who, like him, may have bent or broken a few laws to become rich and powerful.

He’s just one of the few who got caught and punished for it.

* * * * * * * * * *

Comments? Corrections? Questions? Email me or post them on my Famous Quotations Facebook page.

Related viewing and reading…

Starting in the mid-1800s, the phrase “blood, sweat and tears” came to be used by

Starting in the mid-1800s, the phrase “blood, sweat and tears” came to be used by  On May 9, 1940, faced with the failure of his appeasement policy, Neville Chamberlain resigned.

On May 9, 1940, faced with the failure of his appeasement policy, Neville Chamberlain resigned.

It was the first major film role for Derek (who later married and guided the early film career of Bo Derek).

It was the first major film role for Derek (who later married and guided the early film career of Bo Derek).  Indeed, that empathetic concept is a central theme of the book and movie. And, the reason for empathy is memorably summed up by Humphrey Bogart’s character during a courtroom scene.

Indeed, that empathetic concept is a central theme of the book and movie. And, the reason for empathy is memorably summed up by Humphrey Bogart’s character during a courtroom scene.